Prepare an Income Statement Under Variable Costing

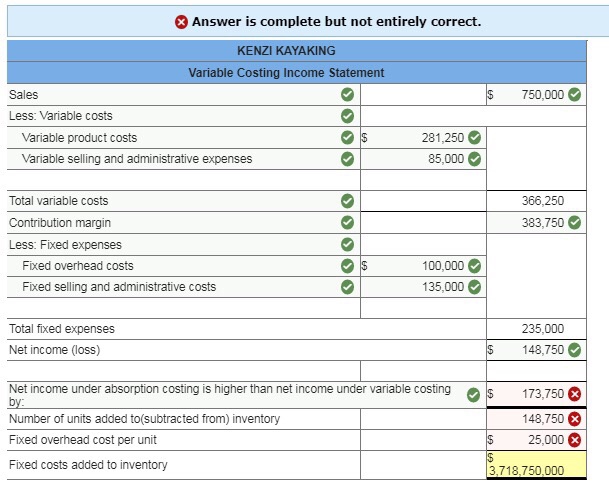

Income will be higher by the fixed overhead per unit 040 times the change in inventory 3000 unit decline or 1200. Fill in the blanks.

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Similarly those profits are known as the contribution to a particular product.

. Marginal Costing Variable Costing Income Statement Format. The following data summarize the results for July. Sales 9500 units 1330000 Production costs 12000 units.

Following information are available for the year ended 30 June 2016. 128000040000 units 2 Income. The 210000 in selling and administrative expense consists of 85000 that is variable and 125000 that is fixed.

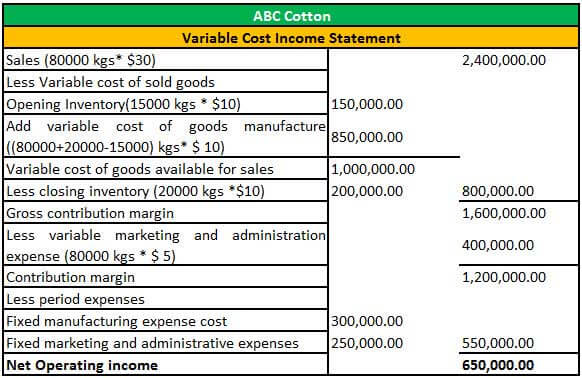

Prepare a variable costing income statement for the three products. Note that in variable costing method fixed manufacturing overhead is treated as period cost. A Absorption costing and b marginal costing.

Prepare an income statement for the current year under variable costing. Enter a net loss as a negative number using a minus sign. Prepare an income statement for the current year under variable costing.

Fi d f t i h dFixed manufacturing overhead. Absorption Costing Income Statement Format. Top Rated Document Platform.

Reconcile the difference between the contribution margin and throughput margin for Garvis in 2017. Prepare an income statement under throughput costing for the year ended December 31 2017 for Garvis Company. Fill in the blanks.

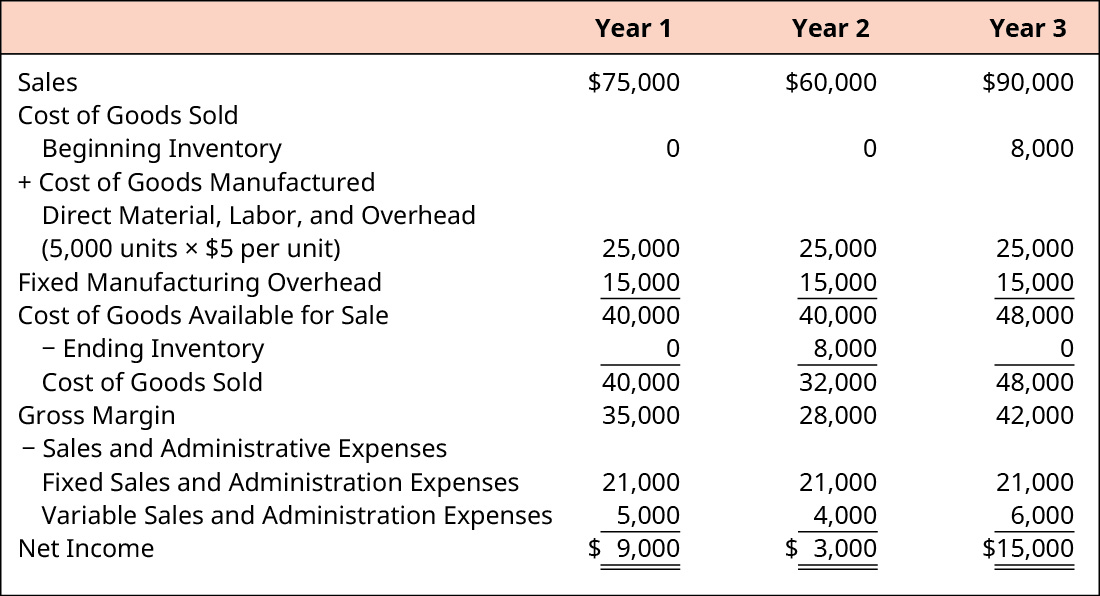

Complete the top half of the income statement for each month first then complete the bottom portion. The company began operations on July 1 and operated at 100 of capacity during the first month. Prepare income statements under variable and absorption costing for the year ended December 31 2004.

Income Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. 2017 FastRide a Prepare April and May income statements for Motors under variable costing. In this statement companies only deduct variable expenses for a specific period.

Under variable costing the following costs are treated as period expenses and are excluded from product costs. 3 When Production is more than Sales. Prepare income statements for each of these two years under variable costing.

What is Zwatchs operating income under each costin g method in. Absorption vs variable costing income statementharper creek wrestling. Assembles and sells snowmobile engines.

It will be more clear from the following illustration. The 230000 in selling and administrative expense consists of 75000 that is variable and 155000 that is fixed. Ad Real Estate Forms Contracts Tax Forms More.

Reconcile net operating income figures obtained under two costing systems. Prepare income statement under. Rey Companys single product sells at a.

2 Reconciliation of net operating income. Loss amounts should be entered with a minus sign DOWELL Company Income Statements Variable Costing Year 1 Year 2 Income Loss Dowell Company produces a single product. Solution 1 Variable costing income statement.

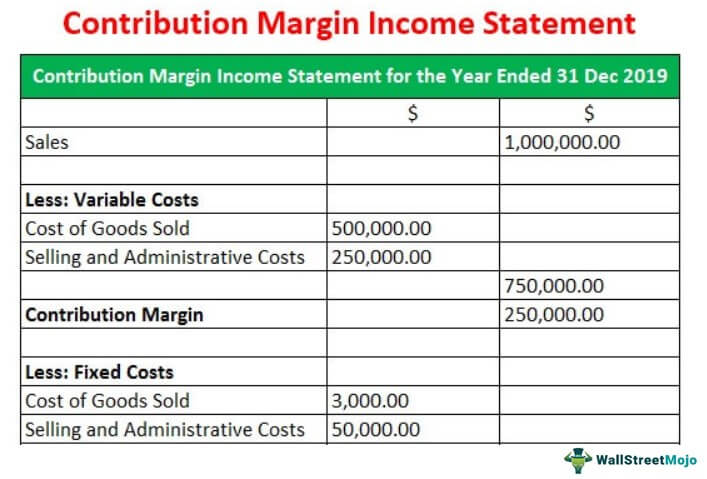

Diablo 2 resurrected exploits ps4. Once it arrives at that contribution the variable costing income statement deducts fixed costs. Then reconcile the operating income between variable costing and throughput costing for Garvis in 2017.

A business sells ice cream. Professional Templates For Any Purpose. Formula Absorption Rate per unit.

Prepare a variable costing income statement using above information. 1 Calculation of unit product cost. A variable costing income statement is a report prepared under the variable costing method.

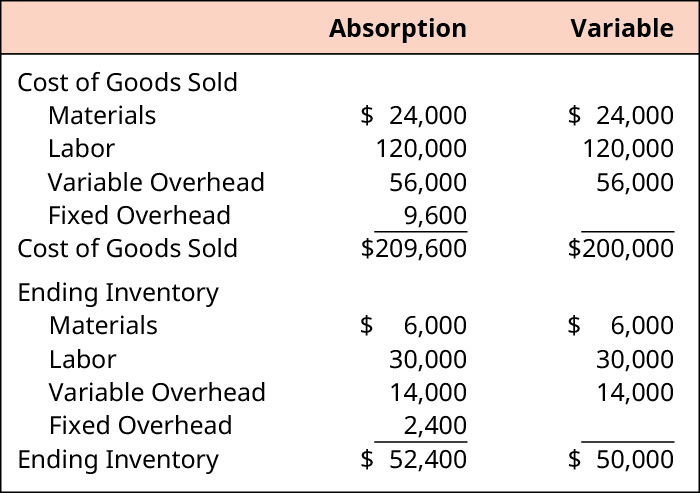

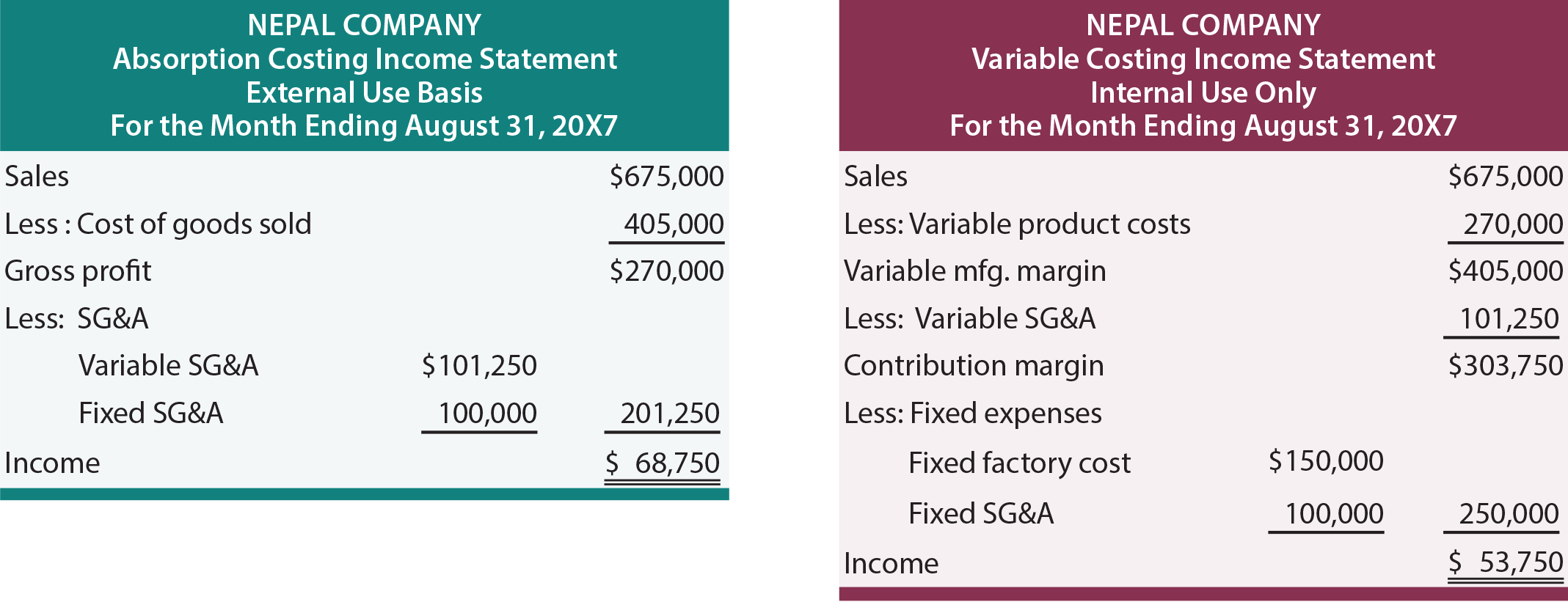

Prepare income statement under two costing system. For reconciliation of net operating income figures. Variable costing is a method that excludes fixed manufacturing overhead from the product cost.

In order to calculate gross margingross profit on sales in the income statement all production expenses both fixed and variable are deducted from the sales revenue. Prepare April and May income statements for Motors under a variable costing and b absorption costing. Income is higher under variable costing because the sales level is greater than the production level.

Variable Costing Income StatementsThree Product Lines For the Year Ended December 31 20Y1 Cross Training Shoes Golf Shoes Running Shoes Contribution. Print Save Download 100 Free. Accounting questions and answers.

Its income statements under absorption costing for its first two years of operation follow. Calculate unit product cost and prepare income statement under variable costing system and absorption costing system. Kenzi Kayaking a manufacturer of kayaks began operations this year.

When closing stock is more than the opening stock ie production exceeds sales profit will be higher in absorption costing as compared to marginal costing. In this statement companies only deduct variable expenses for a specific period. There are two costing methods that can be used by companies in preparing income statement.

Similarly those profits are known as the contribution to a particular product. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately-stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. A variable costing income statement is a report prepared under the variable costing method.

Prepare a schedule to reconcile the net operating income under variable and absorption costing system. April 21 2022. Statement to Reconcile Profits under Marginal and Absorption Costing Format.

Income Statement Under Absorption Costing Administrative selling and manufacturing costs are all separated into three categories by absorption costing.

Income Statement Under Absorption Costing All You Need To Know Cfajournal

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Solved Exercise 6 4 Variable Costing Income Statement Lo P2 Chegg Com

Solved Variable Costing Income Statement Absorption Costing Chegg Com

Variable Versus Absorption Costing Principlesofaccounting Com

Variable Costing Income Statement Examples How It Is Prepared

Solved Variable Costing Income Statement Absorption Costing Chegg Com

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

Contribution Margin Income Statement Explanation Examples Format

Comments

Post a Comment